Public Finance

Deficit Budget

168. The HKSAR Government runs a fiscal deficit in 2019-20, the first time for Hong Kong over the past 15 years. I forecast a deficit for the next five years as well.

169. The US-China trade conflict and the violent incidents in Hong Kong significantly dampened our economic momentum. In the past six months, I have announced four rounds of relief measures costing over $30 billion. These measures, together with the $30 billion Anti-epidemic Fund established in response to the recent novel coronavirus outbreak, resulted in a deficit of about $37.8 billion for 2019-20, which is about 1.3 per cent of GDP.

170. Regarding 2020-21, taking into account the impact of the external economic environment and the epidemic, Hong Kong's economy is expected to be under contractionary pressure, with enterprises facing difficulties and the unemployment rate on the rise. As such, this year's Budget focuses on "supporting enterprises, safeguarding jobs, stimulating the economy and relieving people's burden". Measures for supporting the general public and enterprises, including the cash payout scheme, will be rolled out.

171. Though confident in Hong Kong's fundamental strengths and long-term prospects, I must prudently assess the impact of the current situation on government revenue in the coming year. I thus forecast a decrease in tax and land revenues. Taking also into account the launch of countercyclical fiscal measures on a much larger scale and the continued increase in recurrent expenditure as I have just mentioned, I expect that the fiscal deficit for next year will be $139.1 billion, accounting for 4.8 per cent of GDP.

172. Although the deficit will hit an all-time high, a close look at its components shows that almost $120 billion of the deficit is related to the cash payout scheme and other one-off relief measures, which will not incur long-term financial commitments.

173. Besides, the revenue for the same financial year will include $19.5 billion from the issuance of green bonds and $22 billion brought back from the Housing Reserve. Netting out the aforesaid revenue and one-off expenditure, the deficit is about $59 billion, accounting for 2 per cent of GDP.

174. Our current fiscal reserves of about $1,100 billion enable us to roll out special measures amid the prevailing economic downturn, such as paying out cash. Such special measures and the ever-growing expenditure, however, will deplete our fiscal reserves. Take the 2020-21 financial year as an example. Our reserves which are equivalent to 22 months of government expenditure at the beginning of the year will drop to a level equivalent to 16 months of government expenditure at year-end. If we keep running a fiscal deficit, our reserves will eventually be used up. This is something which we do not want to see. Moreover, the Government will have to draw on the fiscal reserves to meet the funding already earmarked for a number of large-scale projects, for example the two 10-year Hospital Development Plans amounting to about $500 billion in total.

175. It is worth noting that the Operating Account is projected to record a deficit for five consecutive years, as shown in the Medium Range Forecast. In the four financial years starting from 2021-22, there will be an annual deficit of about $50 billion in the Operating Account, and the overall deficit in the Consolidated Account will range between $7.4 billion and $17 billion. That said, the above forecast has not taken into account tax rebate and relief measures that the Government may implement.

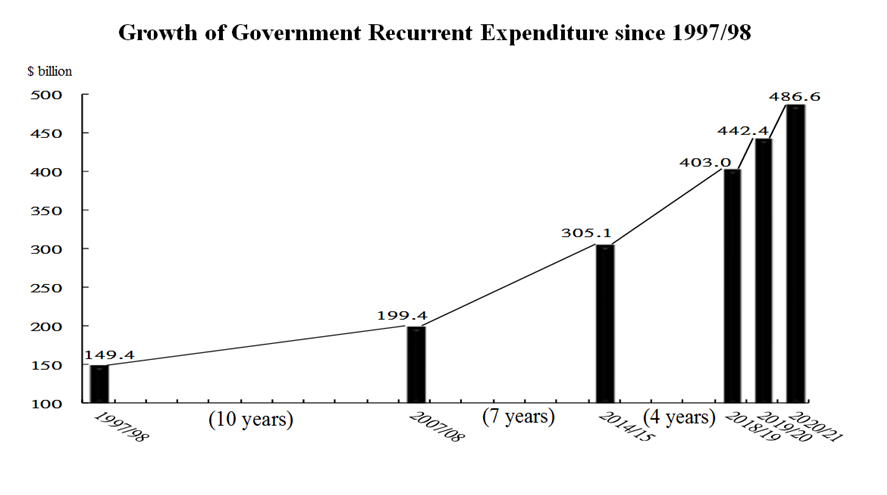

176. The deficits are mainly caused by the fact that government revenue cannot keep up with drastic increases in government expenditure, especially recurrent expenditure. Since reunification, recurrent expenditure increased from $150 billion to $440 billion recorded last year. It started to rise from $150 billion to $200 billion in the first decade after reunification, further increased to $300 billion over the following seven years (i.e. in 2014-15) and to $400 billion after four years (i.e. in 2018-19). For this year (i.e. in 2019-20) alone, recurrent expenditure shows a further increase of about $40 billion, and in the coming year (i.e. in 2020-21), it will be almost $500 billion. Such rapid growth is not sustainable.

| Previous Page | Content | Next Page |